In today’s fast-paced financial landscape, analytics tools are emerging as essential allies for individuals striving to maintain their financial health. These innovative solutions offer consumers new ways to manage their expenses, ultimately helping them steer clear of debt pitfalls.

Gone are the days when manual budgeting and guesswork were sufficient for managing finances. Today, analytics-powered solutions offer personalized advice, forecasting, and real-time data that empowers consumers to make informed decisions.

Understanding the power of predictive analytics

Predictive analytics has transformed the landscape of personal finance by providing users with data-driven insights and foresight. These analytical systems leverage algorithms and historical data to predict future financial outcomes, enabling consumers to anticipate potential risks and opportunities.

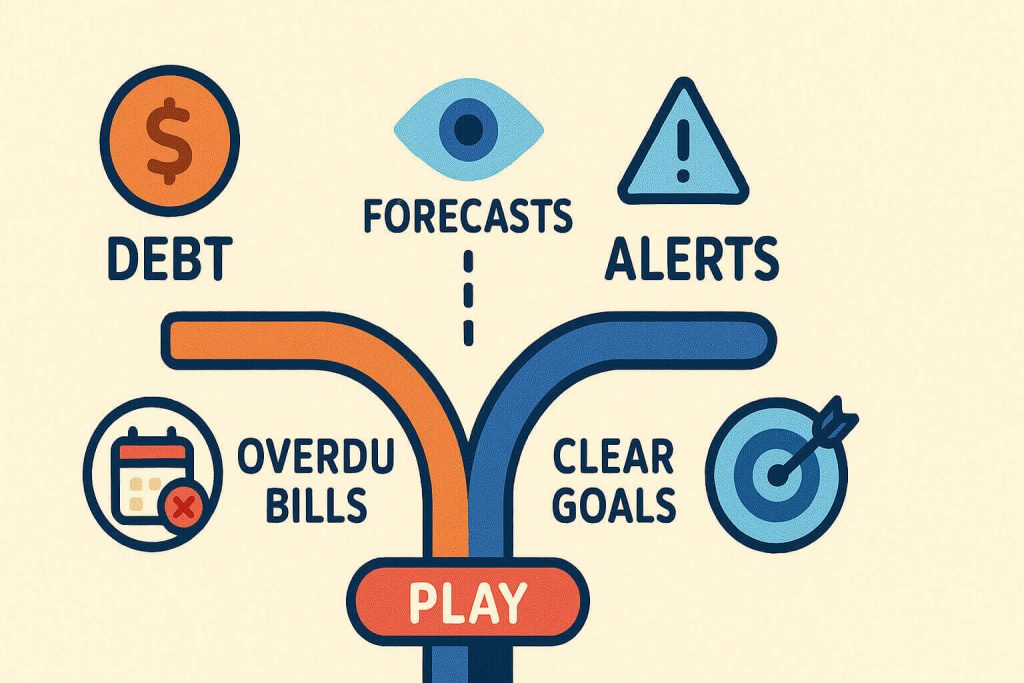

For instance, predictive models may alert consumers to trends in their spending that could lead to potential debt, or highlight areas where cost-cutting measures could be effective. This level of analysis allows individuals to remain proactive rather than reactive, paving the way for more sustainable financial stability.

The role of artificial intelligence in financial forecasting

Artificial intelligence plays a crucial role in enhancing the capabilities of predictive analytics. AI algorithms can process vast amounts of data rapidly and accurately, offering tailored financial strategies to users. These intelligent systems consider a range of variables, such as income patterns, spending habits, and credit history, to generate reliable forecasts.

Moreover, AI-driven tools can continuously learn from user behavior, refining their predictions and recommendations over time. This adaptive learning process ensures that consumers receive up-to-date and relevant advice, allowing them to make well-informed financial decisions and mitigate the risk of potential debt.

The benefits of proactive debt management

Embracing analytics tools for debt prevention has numerous advantages. These solutions empower users to better understand their financial situations, prioritize debt payments, and optimize their budgets. This proactive approach to debt management can lead to improved credit scores, lower interest rates, and reduced financial stress.

Furthermore, consumers who utilize these tools can often identify and rectify poor spending habits before they lead to severe financial consequences. By gaining control over their finances, individuals can achieve greater financial independence and long-term security, creating a stable foundation for future planning.

Implementing analytics tools in everyday finances

Incorporating analytics solutions into daily financial routines doesn’t have to be daunting. Many platforms offer user-friendly interfaces and seamless integration with existing financial management systems. To begin, individuals can connect their bank accounts and credit cards to the analytics tool of their choice, allowing it to analyze their financial activity automatically.

Once set up, users will receive actionable insights through dashboards and notifications, enabling them to make informed decisions on the go. By dedicating a small amount of time each week to review these insights, consumers can maintain a well-balanced financial outlook, preventing the stress and burden of future debt.

Conclusion on leveraging predictive solutions

The advent of predictive analytics tools represents a significant shift in personal finance management, offering powerful resources to ensure financial well-being. By leveraging these solutions, consumers are better positioned to forecast and prevent potential debt scenarios, promoting a healthier financial lifestyle.

As these tools continue to evolve and improve, they hold the promise of further empowering individuals to take control of their financial futures. The journey towards financial independence doesn’t have to be daunting; with the right tools and insights, financial freedom is within reach for consumers across the United States.